- Our agents can help you save

- (888) 676-5927

Updated May 8, 2025

Homeowners insurance is your safeguard against unforeseen losses. However, many feel they are overpaying for their policy, making comparing home insurance quotes a necessity. In this article, we simplify the process, guiding you through how to compare, pinpointing the essential information you need, and helping you select the appropriate coverage—making sure you’re only paying for what you truly need.

A good place to begin is with your car insurance provider. This will allow you to bundle your policies and receive a discount. Keep in mind that this company won’t always be your best or cheapest option, but it gives you a starting point.

Here are three steps to help you find the best homeowners coverage for your needs:

Now let’s go over the steps with a little more detail so you can make the most educated decision when you’re ready to shop.

There are three ways you can receive a home insurance quote.

Regardless of which method you choose, you’ll need to have certain information handy to get homeowners insurance quotes.

Most homeowners insurance companies base their quotes on your home’s replacement cost, which is the amount it would take to rebuild your home in case of a total loss. This value depends on labor and materials, not the real estate market or demand.

No need to stress about knowing the exact dollar amount of insurance you need. Many insurance companies, including Insurance Programs, use your home’s address to automatically suggest basic policy options. Some may even verify your replacement cost through a home inspection.

Your main decision is how you want your home and belongings covered. You’ve got options, ranging from basic to better to best, and the price varies between coverage levels. It’s all about finding the coverage that suits you best, and we’re here to help.

Types of Homeowners Insurance Policies

| Policy Options | Your Home Covered by: | Personal Property Covered by: |

|---|---|---|

| BASIC: HO-2 Broad Form | Named Perils | Named Perils |

| BETTER: HO-3 Special Form | Open Perils | Named Perils |

| BEST: HO-5 Comprehensive Form | Open Perils | Open Perils |

Available in: HO-2 for dwelling and personal property; HO-3 for personal property.

Definition: All the hazards that are not covered will be listed.

Typical Coverage Limits for a Homeowners Insurance Policy

| Coverage A: Dwelling | Your house + attached garage | Varies |

|---|---|---|

| Coverage B: Other structures | Any stand-alone structures — like a carport or tool shed — not attached to the home. | 10% of Dwelling Coverage |

| Coverage C: Personal Property | Coverage can be on a replacement cost or Actual Cash Value basis | 50% of Dwelling Coverage Limit |

| Coverage D: Loss of Use | Cover the cost of temporary relocation in the event the home is unlivable due to covered losses. | 20% of Dwelling Coverage Limit |

| Coverage E: Medical Payments | Covers medical costs incurred on the property by those not listed as residents of the household, regardless of fault. | Custom |

| Coverage F: Personal Liability | Covers the costs of another party’s injuries as well as claims against an insured for property damage | Custom |

If you have these items and their value is greater than the coverage limit, consider adding an endorsement.

Additional information:

As an independent insurance broker, we partner with top home and auto insurance companies across the US. It all begins with your ZIP code, which allows our tool to retrieve home insurance quotes from our partners, giving you the freedom to pick the best option without the usual hassle.

Only with Insurance Programs home insurance comparison tool can you:

And here’s the best part – we respect your preferences. You won’t receive any unsolicited messages or feel pressured to choose a home insurance quote that doesn’t align with your needs. Plus, our services are 100% to you.

Insurance Programs is rated 4.5 out of 5.0 based on 947 reviews.

4.5

out of 947 ratings

Read additional customer reviews and see why Insurance Programs is the #1 insurance comparison site.

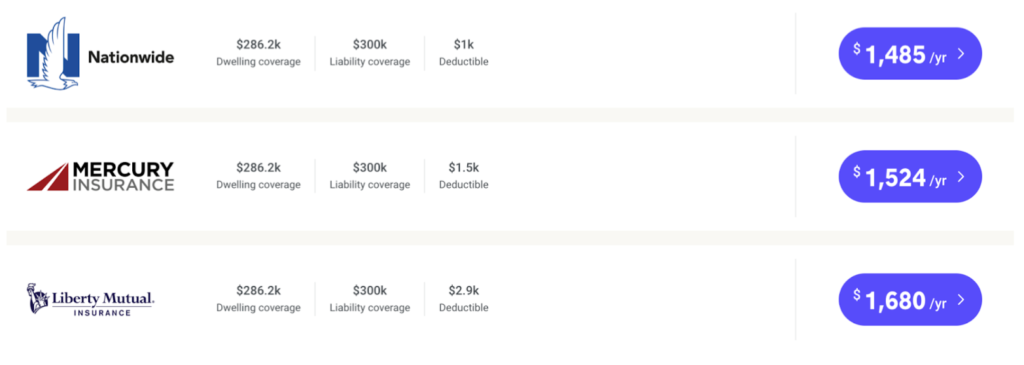

Real image of Insurance Programs product — individual results may vary.

Let’s break down each option before we get started.

Now, we’re ready to compare! We’ll use three key steps to help you efficiently compare your options.

As you shop for homeowners insurance, cost is probably the first thing that will grab your attention. While it’s important to stay within your budget, remember that the cheapest policy isn’t necessarily the best one. If a quote is exceedingly low, make sure that it actually provides the coverage that you need.

Nationwide’s policy was $39 cheaper than Mercury and $195 cheaper than Liberty Mutual.

Average Home Insurance Costs by Company

| Company | Avg. Annual Premium | Avg. Monthly Premium |

|---|---|---|

| Allstate | $1,561 | $130 |

| American Family | $1,764 | $147 |

| Amica Mutual | $2,843 | $237 |

| Farmers | $1,871 | $156 |

Natinwide | $1,231 | $103 |

| State Farm | $1,484 | $124 |

| Travelers | $2,674 | $223 |

| USAA | $1,385 | $115 |

Source: Insurance Programs

Note that Mercury is only available in a handful of states in the US and thus isn’t nationally ranked by many third-party sources. In the states it is available, the National Association of Insurance Commissioners (NAIC) has Mercury rated as “Poor” in customer complaints.

Best Home Insurance Companies

| Home Insurance Company | J.D. Power Customer Satisfaction Rating | A.M. Best Financial Strength Rating | NAIC Customer Complaint Score |

|---|---|---|---|

| State Farm | 4/5 | A++ | Very Good |

| Allsae | 3/5 | A+ | Good |

| USAA | 5/5 | A++ | Very Good |

| Liberty Mutual | 2/5 | A | Below Average |

| Farmers | 3/5 | A | Good |

| Travelers | 2/5 | A++ | Good |

| American Family | 3/5 | A | Good |

| Nationwide | 2/5 | A+ | Very Good |

| Chubb | 2/5 | A++ | Very Good |

| Erie | 5/5 | A+ | Very Good |

In our example, Nationwide has the lowest deductible and the lowest premium.

Keep in mind that this was just an example of shopping for home insurance, but we’d love to help you get your own personalized home insurance quotes! Get started by entering your ZIP code below.

Where you live is a big indicator of how much you will pay for home insurance. Each state has its own set of risk factors (such as wildfires, tornadoes, floods, or other natural disasters) that make home insurance state-specific.

| Home Insurance Rates by State | Cheapest Home Insurance Rates by State | |

|---|---|---|

| Alabama: $1,947 | UAA: $1,452 | |

| Alaska: $1,011 | USAA: $926 | |

| Arizona: $1,410 | UAA: $815 | |

Aransas: $2,143 | Famers: $1,665 | |

| California: $791 | Mercury: $564 | |

| Colorado: $2,271 | American Family: $1,878 | |

| Connecticut: $1,411 | State Farm: $896 | |

| Delaware: $716 | Nationwide: $544 | |

| Washington, D.C.: $940 | Allsate: $885 | |

| Florida: $1,572 | State Farm: $1,261 | |

| Georgia: $1,196 | State Farm: $250 | |

| Hawaii: $349 | Allstate: $283 | |

| Idaho: $1,034 | Farmers: $990 | |

| Illinois: $1,673 | State Farm: $690 | |

| Indiana: $1,343 | Erie: $961 | |

| Iowa: $1,302 | Nationwide: $933 | |

| Kansas: $2,862 | USAA: $1,984 | |

| Kentucky: $2,001 | USAA: $1,099 | |

| Louisiana: $2,037 | State Farm: $1,545 | |

| Maine: $695 | State Farm: $876 | |

| Maryland: $1,042 | Travelers: $796 | |

| Massachusetts: $916 | Amica: $1,278 | |

| Michigan: $1,098 | AAA: $567 | |

| Minnesota: $1,411 | AAA: $1,167 | |

| Mississippi: $1,929 | Allstate: $1,792 | |

| Missouri: $2,185 | AAA: $1,544 | |

| Montana: $2,074 | Foremost: $876 | |

| Nebraska: $2,813 | USAA: $1,890 | |

| Nevada: $841 | Farmers: $553 | |

| New Hampshire: $722 | State Farm: $706 | |

| New Jersey: $706 | Chubb: $661 | |

| New Mexico: $1,203 | Foremost: $1,081 | |

| New York: $980 | State Farm: $692 | |

| North Carolina: $1,661 | Nationwide: $1,591 | |

| North Dakota: $1,682 | AAA: $1,904 | |

| Ohio: $979 | Erie: $747 | |

| Oklahoma: $3,102 | Farmers: $2,676 | |

| Oregon: $876 | State Farm: $760 | |

| Pennsylvania: $1,004 | Erie: $565 | |

| Rhode Island: $1,087 | Amica: $1,097 | |

| South Carolina: $1,556 | Allstate: $1,139 | |

| South Dakota: $2,004 | Farmers: $1,599 | |

| Tennessee: $1,872 | Erie: $1,145 | |

| Texas: $2,387 | State Farm: $2,719 | |

| Utah: $740 | Farmers: $325 | |

| Vermont: $593 | Allstate: $562 | |

| Virginia: $1,294 | Erie: $885 | |

| Washington: $878 | Allstate: $690 | |

| West Virginia: $1,331 | USAA: $834 | |

| Wisconsin: $876 | American Family: $1,020 | |

| Wyoming: $1,164 | USAA: $641 |

Homeowners insurance can be overwhelming and complicated, so take a look at these frequently asked questions that you may also be wondering.

Greetings!Thank you for reaching out to Insurance Programs. This is a great question that can go in a few different directions. But first, let’s address how these are different. Personal property coverage will provide coverage to any personal belongings in the home. Basically, if you were to take the r…

It is my understanding that USAA eligibility flows “downstream” – which means you need to be a child or spouse of an established member to get a USAA policy. Therefore parents, or in your case in-laws, of USAA members are likely not eligible to get their own policy. This applies to all in…