- Our agents can help you save

- (888) 676-5927

Use Insurance Programs’s insurance comparison tool to see rates from GEICO, Progressive, Nationwide, Liberty Mutual and Allstate (+100 other companies).

Updated May 8, 2025

This unbiased guide — written by Insurance Programs insurance experts — outlines the factors that comprise car insurance premiums and provides tips to help you compare quotes and find the right car insurance policy.

Your driving record, your vehicle and where you live are major rating factors for car insurance. But who you trust to insure your vehicle is equally as important.

For example, below you can see the average rates for a 30-year-old male driver with full coverage.

| Company | Avg. 6 Mo. Premium |

|---|---|

| Allstate | $1,206 |

| Farmers | $893 |

| GEICO | $771 |

| Nationwide | $738 |

| Progressive | $941 |

| State Farm | $785 |

| USAA | $683 |

Source: Insurance Programs

Although the driving profile is the same, there’s still hundreds of dollars in premium difference between the cheapest and most expensive company. This price difference shows why it is so important to compare multiple providers. Even if your driving profile or vehicle is the same, the rate a company charges for its services is not.

Of the companies listed above, USAA is one of the cheapest but it’s also the most exclusive. USAA is only available to military members and their families – so while the lower premium is appealing, not everyone will qualify.

Although Allstate is more expensive, it does not have occupation restrictions and it’s one of the best and largest insurance companies. For many customers, the peace of mind and availability of local agents is worth the additional cost.

Outside of its services, a company might be more expensive because of simple economics. If your current company paid out more claims than it earned in premium, it could account for that by increasing rates next year.

Even if you didn’t file a claim, your rate can still increase because your insurance company’s cost of doing business increased. In fact, 43% of customers who use our product state they are paying too much with their current provider.[2]

Sometimes an insurance company is cheap for a reason. After an accident is not the time to wish you’d known about your provider’s poor customer service and claims record. Before purchasing a policy, pay close attention to national and regional reviews like Insurance Programs Satisfaction Survey.

Regardless of how you get car insurance rates, you’ll first need the following information handy:

*Note that you can get a quote without a VIN or driver license number, but you will not be able to buy your policy without it.

The benefit of using online insurance comparison sites is obvious: avoid the tedious task of going through the quoting process for many different companies.

But be careful, many of the popular sites aren’t comparison tools — they’re just ads. Lead aggregators who will sell your data to insurance companies who contact you relentlessly in pursuit of your business.

If you want to avoid spam emails, texts and phone calls, pay close attention to the website’s privacy disclosures and how they earn money. We recommend looking for websites or companies that are independent agents of insurance providers. Independent agents are licensed and authorized to write policies for multiple insurance companies

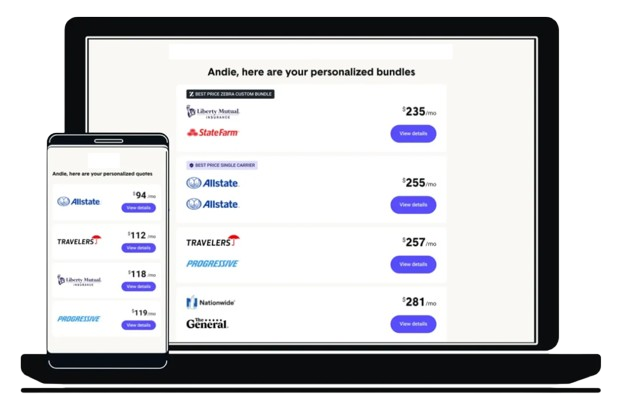

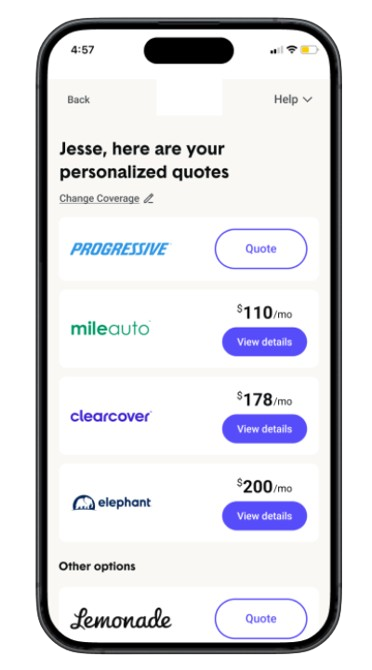

This is exactly what Insurance Programs is. Only with our comparison tool can you fill out 1 form to get multiple quotes — all on a single page. Our team of independent insurance agents partners with over 100 partnerships across the US. Together, we can help you compare policies by price and by how much car insurance coverage you want.

Insurance Programs does not partner with any lead generation sites. We never sell your information. We earn money by helping you get insured, but we will not sell you a policy if you already have the appropriate coverage at the best price.

Real image of Insurance Programs mobile experience — individual results may vary.

Insurance Programs is rated 4.5 out of 5.0 based on 947 reviews.

4.5

out of 947 ratings

Read additional customer reviews and see why Insurance Programs is the #1 insurance comparison site.

Insurance Programs leads the way in simplifying insurance shopping, but we’re not alone in this growing space. Explore how Gabi, Insurify, and Compare.com approach insurance comparisons and carrier reviews.

Gabi compares quotes from 40+ companies, offering a 5-minute process per product with purchase options online or by phone.

Insurify partners with top insurers and connects customers with licensed agents through its in-house agency. However, a phone number is required for quotes.

Compare.com lets users compare insurance quotes but may offer limited results and share your info, leading to unwanted contacts.

Get 4 expert tips on comparing rates, plus access to a price tracker that automatically finds your best deal.

We’ve talked about the big reasons why you should compare, but now we’ll talk about who you are and how that impacts what you’ll pay for car insurance.

We will outline in more detail the impact your age, driving history, and credit score impact your rates. It is worth noting there are other factors you should keep in mind:

| Company | Avg. 6 Mo. Premium |

|---|---|

| Farmers | $1,139 |

| USAA | $863 |

| Progressive | $1,224 |

| Allstate | $1,542 |

| State Farm | $1,045 |

| GEICO | $936 |

| Nationwide | $982 |

Source: Insurance Programs

Rates change as drivers age. If you’re looking for more information about how your age can impact your car insurance, check out our guides below:

Insurance companies use your previous driving history as a predictor for future driving behavior. Speeding tickets, DUIs, and at-faults accidents can be “chargeable” offenses on your driving record for 3-10 years (depending on your state). If you have any of these or similar driving violations, shopping around as often as possible is pivotal.

| Company | Avg. 6 Mo. Premium |

|---|---|

| USAA | $864 |

| Travelers | $926 |

| American Family | $949 |

| State Farm | $974 |

| Nationwide | $1,036 |

| GEICO | $1,115 |

| Farmers | $1,148 |

| Progressive | $1,404 |

| Allstate | $1,675 |

Source: Insurance Programs

Driving infractions can have a serious impact on your car insurance. Insurance Programs has put together the following handy guides on how your insurance is impacted by certain driving violations.

More and more states are banning credit scores as a rating factor for auto insurance. However, it’s still a pretty common practice. Historical claims data tells insurance companies that drivers with poor credit tend to file costlier claims more frequently.

Below you can select your credit level to compare rates from top auto insurance companies in the US.

| Company | Avg. 6 Mo. Premium |

|---|---|

| USAA | $731 |

| Travelers | $743 |

| Nationwide | $810 |

| GEICO | $822 |

| American Family | $847 |

| State Farm | $912 |

| Farmers | $954 |

| Progressive | $1,056 |

| Allstate | $1,287 |

Source: Insurance Programs

Data Methodology. Insurance Programs Dynamic Insurance Rating Tool

Anonymized User Survey. Insurance Programs

No, we're an insurance comparison site. The big difference is that we compare the top insurance companies in one place to help you find the best policy for you.

All it takes is five minutes. You answer some questions, we'll crunch the numbers to show you quotes from every major insurance company. After you decide on a policy, you can buy online or through one of our licensed insurance agents.

Ready to try it out for yourself?

Each of our independent insurance agents is licensed to offer policies from every major provider. As your needs change, they'll always be there to help you find the coverage you need.

It's your call. If you want to purchase a policy directly through your provider, they'll have your quote ready. Or you could skip the trip to another site and buy a policy through Insurance Programs. No matter which you choose, it's the same policy.

Yes. As real people with real data, we understand the importance of keeping your personal information private. That's why we pledge to never sell your data to spammers.

If you stop paying for the SR-22, the insurance company is then required to notify the state that the policy has been canceled. Typically, the state will suspend your license and you may have additional fines as well. Keep in mind that license suspensions show up on your motor vehicle report which …

The short answer is yes, Virginia does require you to have basic liability insurance in order to register your vehicle in that state. If it’s helpful, Insurance Programs can help you get car insurance quotes from several carriers in your state. You can also give us a call at 888-807-3823 to speak to an…